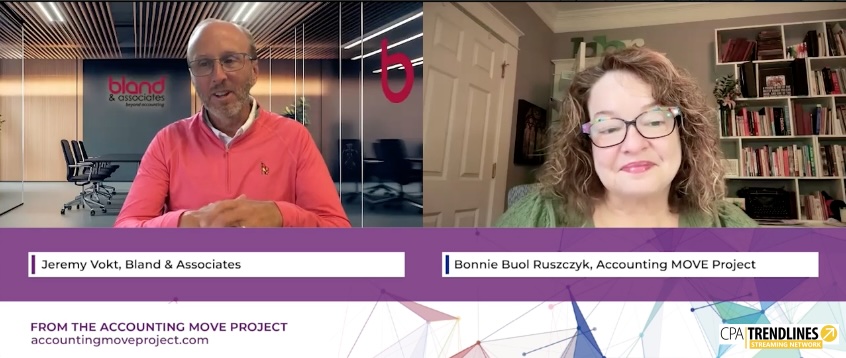

In this episode of MOVE Like This, Bonnie sits down with Jeremy Vokt, managing partner at Bland & Associates, to discuss the firm’s transformation into Nebraska’s first ESOP-owned CPA firm. Since its early days as a 17-person firm in 2006, Bland has grown to 130 employees by blending traditional accounting with specialized government consulting in Medicare and Medicaid compliance. Jeremy explains how their Employee Stock Ownership Plan (ESOP) works, similar to a 401(k), but without employee contributions, as staff earn shares annually based on compensation. This structure creates an ownership mindset from day one, ensuring every employee, from the front desk to the managing partner, shares in the firm’s success.

The decision to adopt an ESOP came after Jeremy and his partners evaluated succession planning options and found traditional models lacking in clarity and fairness. With help from an advisor and after successfully advocating for a legal change to allow ESOP ownership of CPA firms in Nebraska, Bland officially transitioned on January 2, 2020. Despite the pandemic hitting soon after, the ESOP proved resilient, helping the firm retain staff and strengthen engagement during uncertainty. Today, Bland continues to emphasize transparency by openly sharing financials, stock values, and strategic goals, supported by the Entrepreneurial Operating System framework.

For other firms considering an ESOP, Jeremy advises seeking out peers, learning from associations, and honestly assessing cultural readiness. While it may not be the right fit for every firm, Bland’s experience shows how ESOPs can align culture, succession planning, and growth. helping firms remain independent while fostering accountability and shared ownership.

Key Takeaways:

- Choose Ownership That Matches Your Values:Bland & Associates chose the ESOP route to stay independent, align with their culture, and reward long-term commitment rather than sell to PE or pursue M&A.

- Engagement Starts with Equity:Employees earn shares based on tenure and salary proportion very early in their tenure. This model fosters loyalty, retention, and shared purpose across all levels of the firm.

- Transparency Builds Buy-In:Bland has long practiced financial transparency, but becoming an ESOP elevated it further, tying strategy, performance, and stock value together so everyone understands how their work drives firm success.

- Strategic Planning Requires Constant Motion:Using the Traction EOS system, the firm maintains momentum with regular check-ins and visible goals, keeping strategy top of mind and aligned with employee ownership.

- It’s Not Just for Factories Anymore:While ESOPs were once rare in accounting, Bland is proof they can work for professional service firms, especially those with a strong culture, long-term vision, and commitment to employee growth.

We are pleased to partner with CPA Trendlines for podcast distribution now too. Anyone can listen to the episode, but you need to be a subscriber to watch the video version. Check it out here!